Whenever you see a headline that poses a question, the answer to that particular question is usually a big fat no. However, when it comes to software development for next-generation car infotainment systems like Android Auto and Apple Carplay, that’s not the case. If you can spare a few minutes, I will try to explain why.

We’ve all heard talk of autonomous, driverless cars for years, and many of us had a chance to try out some rudimentary implementations of such technologies, which are slowly making their way to mainstream cars. This post won’t deal with those for the following reasons: driverless cars are still years away, they will be closed for development, and they will not create a new market for developers, not unless you want your car to be parallel parked using code written by a 16-year-old coder freelancing for $5 an hour.

However, cars with next-generation connected infotainment systems will create new opportunities on several fronts. In case you already have an infotainment system with a neat touchscreen and GPS in your car, please accept my condolences; it’s about to become as obsolete as a Nokia 3310 compared to an iPhone.

Next-gen infotainment platforms are to current systems what smartphones are to feature phones.

I know that is a bold statement, and many of you won’t agree with me, but I like to kick off on a provocative note. I will do my best to change your mind, and if I fail, feel free to let me know in the comment section.

Evolution Of Car Infotainment Systems, Or Lack Of It

So what’s so wrong with the current generation of car infotainment and navigation systems? How come many of us chose not to buy them? Why don’t we see a lot of development in this niche?

It all boils down to a combination of technical and economic considerations. Consumer tech is rendered obsolete in years, roughly two product cycles for smartphones, three to four cycles for desktops and laptops. That usually translates into two to five years. Naturally, as products mature, their lifecycle is extended as well.

The car industry does not work that way, so very few of us go out and buy a new car nearly as often. In fact, many new cars ship with three- to five-year warranties, so most people are unlikely to sell them for five or more years. Cars are built to last a decade or more, and they can’t be upgraded like desktop PCs, or receive OTA updates like our smartphones.

But hold on, why don’t carmakers simply install off-the-shelf technology employed in tablets and smartphones? Why do we still have expensive dials if it would be cheaper to replace them with a high-resolution panel used in $200 tablets? The answer is simple; it wouldn’t work.

Automotive electronics are a world apart from consumer tech. While they can be based on similar chip architectures and technologies, they need to be a lot more durable. Unlike your iPad, your car infotainment system has to put up with a very hostile environment and deal with loads of potential issues:

- Constant vibrations and G forces.

- Extremely high and low temperatures.

- Ability to stand up to high levels of humidity, or the occasional splash of water.

- MTBF has to be much longer.

- When they fail, they need to fail safe.

- Infotainment systems are integrated with numerous other components.

- Legal and regulatory issues must be addressed.

I could expand this list, but I think it’s enough to prove my point; a car infotainment system and an iPad don’t have that much in common. They may share the same DNA, but the same goes for a MacBook Air and a Panasonic Toughbook.

The good news is that developers needn’t be concerned by any of these issues, because they will be addressed by carmakers and tech companies trying to slide their foot in the door and grab a piece of this emerging market. That leaves us with good old chips and operating systems, and whether they’re in a desktop, smartphone, smart toaster or a new car, they all speak the same language; they all execute code.

What Sort Of Technology Is Coming To Our Cars?

A number of tech heavyweights, including Apple, Google, Texas Instruments, and Nvidia, have already entered this market. You can already buy cars equipped with some of these systems, and some solutions like Nvidia’s Tegra-based infotainment platforms, have been on the market for years.

The next obvious step is to open up these platforms and get more brands, and consumers, on the bandwagon.

Google Android Auto and Apple CarPlay are bound to dominate this space for years to come. In case you would like to check out a head-to-head comparison of the systems, you can head over to CNET.

Now, these platforms don’t have much in common with driverless cars, autonomous cars or whatever you choose to call them. They are merely a replacement for the “dumb” infotainment systems we have today. Here is an analogy that should explain what’s about to happen: next-gen infotainment platforms are to current systems what smartphones are to feature phones. They have a lot more potential for future development, integration with other devices, fast mobile broadband connectivity, and so on.

In terms of hardware, we will see more powerful System-on-Chip (SoC) solutions, capable of providing fast 4G data, stunning graphics, improved GPS capabilities, and even some cutting-edge features such as motion tracking.

For example, Nvidia is trying to leverage its GPU technology to enable motion tracking that should provide drivers with better situational awareness. This does not mean we’ll end up with driverless cars powered by Nvidia SoCs, but the technology could be used to look out for obstacles when parking, cars in our blind spots and so on. Not long ago, the computational power needed to pull this off was reserved for professional graphics solutions, but the latest crop of Nvidia Tegra processors features 192 GPU cores, or CUDA cores to be precise. Upcoming Tegras will feature even more powerful CPUs and additional CUDA cores (256 and more cores).

Even the current generation is powerful enough to enable the development of autonomous cars, let alone vehicles with some rudimentary motion tracking features. In case you are interested in the geeky details, you can check out this Nvidia blog, detailing how a Jetson TK1 development board can be used for low-power sensing and autonomy.

The really good news is that the industry will be able to use vast amounts of CUDA code, developed for discrete graphics cards. It will work on Nvidia mobile platforms as well. The bad news is that Android Auto and Apple CarPlay simply won’t harness this potential, at least not yet. Instead, they will act as “second screens” for our mobile devices.

Bottom line; hardware will not be an issue.

What Does This Mean For Developers?

By this point, many of you are probably asking this question. The potential for third-party development on these platforms will be limited; people won’t use them to browse or play games. Certain apps are off the table for safety considerations, the size of the market will remain limited for years, and growth will be slow due to long product lifecycles.

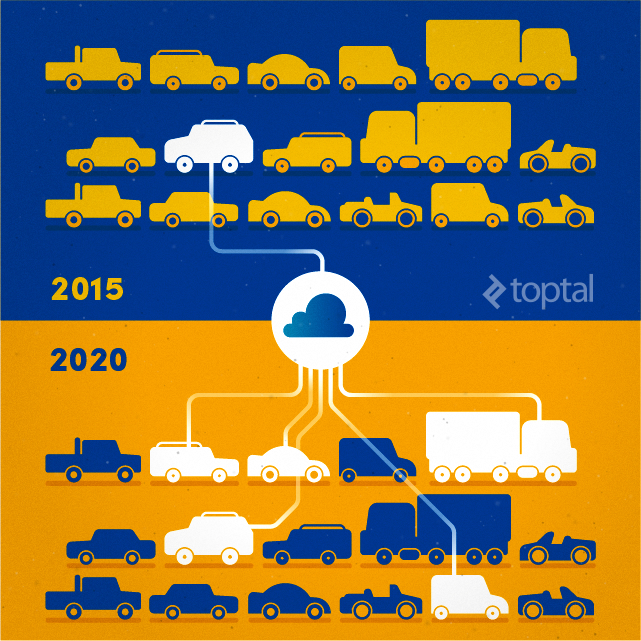

ABI Research estimates Apple CarPlay will be installed in about 24 million new cars shipped in 2019. The research outfit also expects Android Auto uptake to accelerate and be “more aggressive than CarPlay.” In any case, these numbers don’t look too exciting, at least not from our perspective. More than a billion smartphones are shipped each year, so shipping about 50 million cars with next-generation infotainment systems four years from now doesn’t look impressive. However, these cars will be on our roads for about a decade, while smartphones and tablets are rendered obsolete and replaced in 2-3 years. In spite of low overall sales, the infotainment user base will grow and by the end of the decade we could be looking at a couple of hundred million new cars with fancy infotainment systems on our roads. Now that sounds a bit more tempting, does it not?

The user base will be limited for years to come, but it boils down to quality over quantity. Those buying a $50,000 Audi with a new infotainment system can afford a few premium apps for their new toy. This is not the case with hundreds of millions of phone users, who simply don’t use paid apps at all.

But what are people going to develop for these things to begin with?

Well, to be perfectly honest, not much. While these units may be viewed as standalone platforms, with more than adequate hardware and software capabilities, in reality they will be used as “second screens” for mobile devices, they are projected from your smartphone to the infotainment system. There’s nothing wrong with that, and developers are already tackling wearables in a similar way.

This means we will end up with two approaches:

- Standard mobile apps that will use infotainment systems as a second screen.

- Apps developed specifically for automotive infotainment.

Developers working on certain types of applications that may be useful in cars will have to make sure that they work well on infotainment systems. The number of applications that could be considered useful in a car is limited. Apart from core apps, which will be preinstalled on these systems anyway, there won’t be a lot of room for standard mobile apps tweaked to run on infotainment systems. Games, fitness apps, outdoor apps, news readers, social apps – very few of them would make sense in a car.

The second approach looks more challenging, but it could prove more lucrative in the long run. There is no “killer app” specifically designed to use the multitude of sensors on our phones that will seamlessly integrate with infotainment systems. After all, would you rather have a killer app running on 10 percent of all deployed automotive systems than a mediocre iOS app installed by 0.1 percent of iPhone users? What if your team comes up with something truly useful and original, and eventually big carmakers start preinstalling your app on their systems. Long drinks on the yacht, anyone?

But what could third party developers create? Core apps will handle a lot of stuff, complemented by major services like Spotify, or TuneIn radio. The real question we should be asking is what we would want to use while driving, so here are a few basic apps, features, and services the average user would like to see on their infotainment screen.

- Maps and navigation.

- Voice calls and messaging.

- Relevant notifications.

- Music and radio.

- Voice control.

It’s clear most of this will be covered by core apps, but there is always room for improvement. A lot of content streaming services are bound to pounce, because everybody loves good tunes on the road, whether they are streamed from your personal collection in the cloud, or if you are into talk radio. Maps and navigation are also covered by core apps and popular third-party solutions. Core apps will handle notifications, voice calls, messaging and voice commands.

Creating Opportunities For Small Developers

This does not leave much room for small third-party developers or startups keen to get in on the action. They will have to be creative and carve out an all-new niche if they want to make it big. They will have to be original, or cater to a very small group of potential users, like motoring enthusiasts.

This is an obvious problem, because small developers can be very agile, innovative, and they are a vital part of any app ecosystem. Still, this does not mean there is no room for them. Monetization will be a problem because startups and independent developers won’t be able to rely on ads. Even if they could, it wouldn’t make much difference due to the small user base and the fact that these apps wouldn’t be used nearly as often as their smartphone counterparts. Few automotive apps will be free (save for existing services trying to enter a new market), and I suspect many niche apps will end up with a hefty price tag to justify development and ensure ROI in a reasonable timeframe. There is also a chance industry leaders will try to subsidise development, but it’s too early to say.

Personally, I am a cautious optimist. We will see people with good ideas and the know-how to execute them and create entirely new services for these platforms. It might not be as straightforward as creating a cross-platform app, but risk-takers often hit the bullseye and build successful services.

So let’s take a look at what could be accomplished and which niches could be covered:

- Road safety.

- Security and insurance liability.

- Applications for motoring enthusiasts.

- Fuel economy applications.

- Health and ergonomics.

Safety is obviously a great selling point, so developers could focus on some aspects not covered by core apps. It all depends on how elaborate the infotainment system is, whether it is opened up properly, and if there is room for improvement on preinstalled, stock solutions.

For example, how about an app that would collect anonymous information on the average speed of vehicles traveling on a particular stretch of road? Store the info in the cloud, match the vehicle type, road conditions, eliminate the outlier results (top and bottom 5%), and you could end up with a very simple way of informing the driver whether or not they are driving in a safe speed range (which they could define themselves, matching their personal preferences, abilities and their vehicle). If you are approaching a few hairpins, the system could warn you that other drivers slow down just behind the curve, or that they know something you don’t (i.e. the location of speed cameras). This would allow all drivers to rely on the experience of other drivers who are familiar with that particular road.

Security and insurance liability is another niche that could make a lot of sense, especially in some markets. In certain parts of the world, a huge number of drivers rely on dashcams. They act like cheap black boxes and help clamp down on insurance fraud. As an added bonus, we also get to see some amazing YouTube videos. A modern infotainment system could provide a lot more information than a dumb dashcam. You could extract location, acceleration/deceleration data, speed at impact and so on. This would, obviously, make many court cases and insurance claims an open and shut affair.

Theft is another problem, although it would be much harder to address with technology. Sure, you could set up some IP cameras that could identify the car thief as soon as they break in, but there is an inherent weakness to this approach; professional crooks already use jammers for cell phone frequencies and GPS signals.

Petrol heads might get some interesting apps that would allow them to interface with the vehicle’s On-Board Diagnostics (OBD) system. This would save a few expensive and unnecessary trips to the garage, but it could also provide motorists with additional information. Some of it could be displayed in real time, transforming the infotainment screen into a bunch of dials capable of displaying info the average driver couldn’t care less about. Some developers have already made a name for themselves in this niche, and if you are not familiar with the concept, you can check out the highly acclaimed Torque Pro app for more details.

Fuel economy could be improved with smart tech as well. The system could track your commute and figure out the most economical route, the most frugal driving style, and it could help you track expenses, compare prices at different petrol stations and so on. This could be of particular interest to fleet operators and businesses in general.

Health apps aren’t an obvious choice when it comes to automotive platforms, but bear with me. Thanks to wearables, we could feed the system with some important data, like the heart rate of the driver, physical activity and movement, and so on. The infotainment system could warn drivers to take a break if they are stressed out, or if they haven’t taken a break and stretched their legs for hours. What if new cars integrate driver-facing cameras? Those could also be used to check the driver’s posture and sound off if they notice the driver is about to doze off behind the wheel.

Why Develop For Apple CarPlay And Android Auto?

If you are interested in checking out the automotive niche, and if you think you have what it takes to develop for Android Auto, or Apple CarPlay, the official dev pages are the obvious place to start.

The Android Auto developer page offers a lot of useful info and resources, with more on the way. The focus is on extending your app to work in vehicles, so Google offers clear guidelines for Android Auto UI design, messaging apps, audio apps and so on. The best practices section is home to a lot of helpful info, so be sure to check it out if you want to get a clear picture of Google’s vision.

There aren’t as many freely available resources for Apple CarPlay, at least not for the time being. Since both platforms are still wet behind the ears, it’s understandable that the volume of documentation is limited.

On the face of it, the two platforms are similar, but Google’s appears to be more flexible and “smarter.” Since both are likely to evolve, it’s too early to pass judgement and say which will come out on top. I already mentioned some market forecasts, and it seems that both platforms will be evenly matched in terms of overall sales.

However, there are a few considerations developers should keep in mind. Since the lifecycle of these products will be much longer, users will be stuck with whatever they get for years. This isn’t a big deal when you buy a $300 tablet, but what about a $30,000 car? What if you decide to swap your Nexus for an iPhone, or vice versa? Well, you might as well buy a new car, because it won’t work. It’s probable that these systems will lock in users for years, forcing them to choose a mobile platform when they buy a new car, and stick with it. Most car makers are expected to offer both systems (as an optional extra, obviously), but this is not an elegant solution. What if your spouse or kids don’t use the same mobile OS as you? What if your car’s resale value is negatively affected by your choice of infotainment platform?

What about older cars? The good news is that aftermarket head units with CarPlay and Android Auto are showing up, but they aren’t cheap. Sooner or later Chinese white-box outfits will start making their own versions for a couple of hundred bucks. However, installing aftermarket head units in many modern cars can be tricky, so it’s a turn-off for many car owners.

In any case, despite their limitations and slow uptake, smart automotive platforms will become a significant niche market by the time the decade is out. Hardware outfits and carmakers will make a few billion dollars, but the potential for developers will remain limited for years to come.

This article was first published on TOPTAL at https://www.toptal.com/android/is-developing-for-car-infotainment-systems-the-next-big-thing